Hi there! If you want to know about TTB Bank, you’re in the right spot. TTB stands for TMBThanachart Bank. It’s a big bank in Thailand. They help people save money, borrow cash, and grow their funds. We will cover all the basics here. Plus, we’ll add extra tips to make your life easier. Let’s jump in.

The Story Behind TTB Bank

TTB Bank started from two old banks. TMB Bank and Thanachart Bank joined forces. This happened back in 2021. Now, they are one strong team. They serve millions of people in Thailand. The bank focuses on making banking simple and fun. They use new tech to help you bank from your phone. But they also have branches if you like face-to-face help.

One cool fact: TTB means “Touch the Brush.” It shows they want to paint a better future for you. In recent years, like in 2026, they did big things. For example, they bought back shares to help investors. This shows they care about growth.

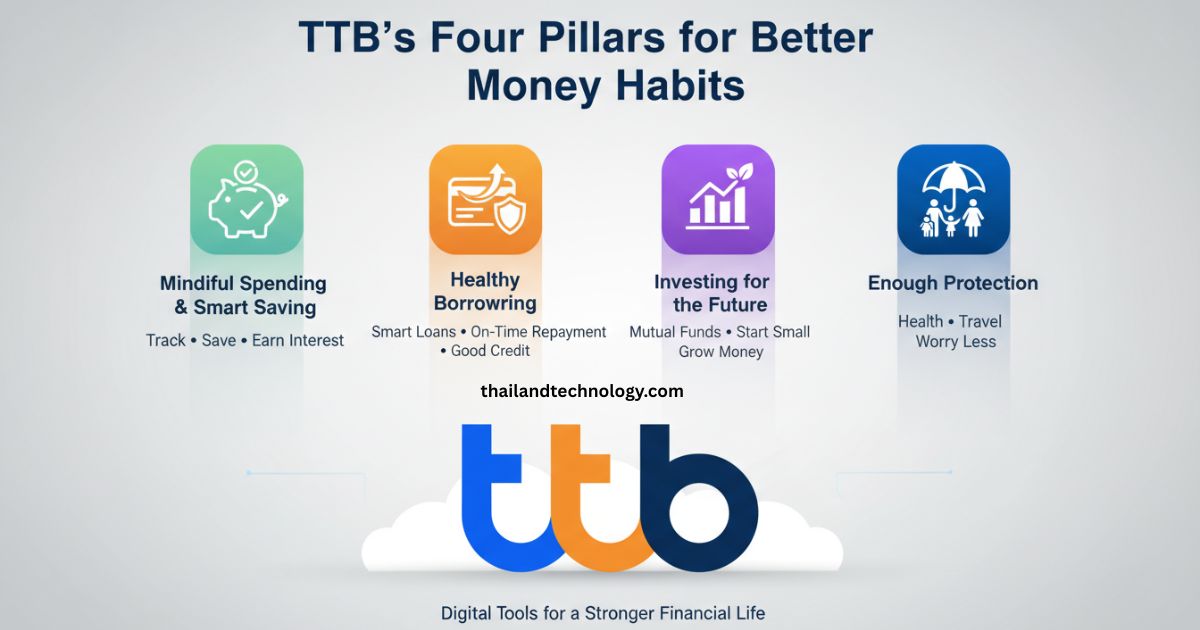

TTB’s Four Pillars for Better Money Habits

TTB has four main ideas to help you with money. They call them pillars. Each one makes your financial life stronger. Think of them as steps to smart money use.

Mindful Spending and Smart Saving

This pillar is about not wasting cash. Save what you can. TTB offers easy accounts for this. You get tools to track your spends. Plus, high interest on savings to grow your money fast.

Healthy Borrowing

Need to borrow? Do it wisely. TTB helps with loans that fit your needs. They teach you to pay back on time. This keeps your credit good.

Investing for the Future

Grow your money over time. TTB has mutual funds. These are like baskets of investments. You can start small and watch it build.

Enough Protection

Life can surprise you. Get insurance to stay safe. TTB offers plans for health, travel, and more. This way, you worry less.

These pillars cover what the old banks did. But TTB makes them better with app tools.

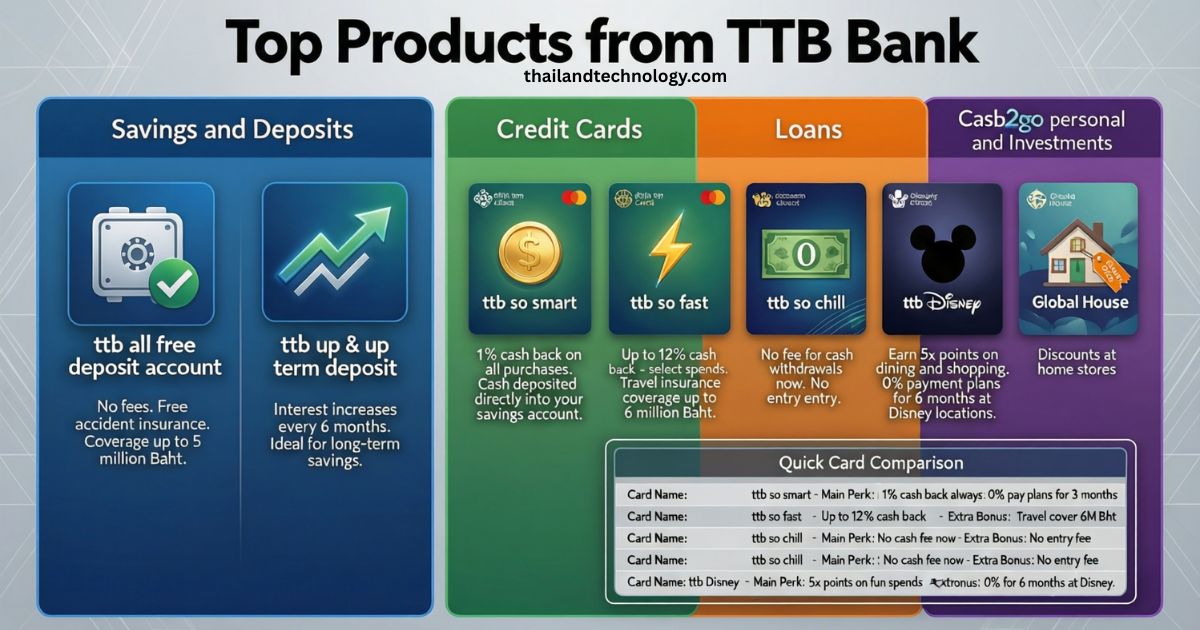

Top Products from TTB Bank

TTB has lots of stuff for personal banking. We list the main ones here. Each helps with daily money needs.

Savings and Deposits

Save your cash safely. Try the ttb all free deposit account. It has no fees. Plus, you get free accident insurance. Coverage up to a big amount if something bad happens.

Or go for ttb up & up term deposit. Interest goes up every six months. Great for long saves.

Credit Cards

Cards make shopping easy. TTB has fun ones.

- ttb so smart: Get 1% cash back on all buys. Cash goes straight to your save account.

- ttb so fast: Up to 12% cash back on some spends.

- ttb so chill: No fee for cash pulls right now.

- ttb Disney: Earn points on eats and shops. 0% pay plans at Disney spots.

- Global House: Discounts at home stores.

No yearly fees on many. Plus, travel insurance up to 6 million Baht.

Here’s a quick table to compare cards:

| Card Name | Main Perk | Extra Bonus |

|---|---|---|

| ttb so smart | 1% cash back always | 0% pay plans for 3 months |

| ttb so fast | Up to 12% cash back | Travel cover 6M Baht |

| ttb so chill | No cash fee now | No entry fee |

| ttb Disney | 5x points on fun spends | 0% for 6 months at Disney |

Loans

Need quick cash? Cash2go personal loan is easy. Get up to 5 times your pay. Max 2 million Baht. Pay back over 72 months. Apply fast online.

Insurance and Investments

Protect yourself with plans tied to accounts. For invests, try mutual funds. They fit your risk level.

Read: Chat GPT 4.0 Explained: Features, Pricing & How to Use in 2026

Current Deals and Promotions in 2026

TTB loves good deals. Right now, in 2026, check these.

- Credit cards: 0% pay plans on big buys. Like 3 months free interest.

- Deposits: Special rates on up & up accounts. Interest climbs higher.

- Loans: Low rates for new users.

- Extra: Free insurance with some accounts. Plus, cash back on daily spends.

These change often. But they beat what others offer.

How to Start Banking with TTB

Ready to join? It’s simple.

- Download the ttb touch app.

- Sign up with your ID.

- Pick a product like a save account.

- Add money and go.

Or visit a branch. They help in person. No big papers needed for basics.

We added this section because starting out can feel hard. Now it’s clear.

Why Choose TTB Over Other Banks

TTB stands out. They merge old strengths into new perks. Other banks might have fees. TTB cuts them. Their app is super easy. Plus, pillars guide you better.

Compare: Some banks give low interest. TTB boosts it. Loans are fair. And deals save you cash.

This makes TTB a top pick in Thailand.

Conclusion

TTB Bank (TMBThanachart) stands out as a smart, modern choice for anyone in Thailand who wants better control over their money. With easy savings accounts that grow your cash, flexible loans without hidden traps, rewarding credit cards that give real cash back, and strong protection options, TTB helps you spend wisely, borrow safely, invest smartly, and stay protected.

Their simple app and no-fee basics make daily banking painless. Plus, the latest 2026 deals add extra value right when you need it most.

FAQs About TTB Bank

We answer common questions. More than what others share.

What does TTB stand for? TMBThanachart Bank. It’s from two banks that joined.

Is TTB safe for my money? Yes. They follow Thai rules. Your cash is protected.

How do I apply for a credit card? Use the app or site. Need your income proof.

What if I need help? Call their line or chat in app. Fast response.

Are there fees for accounts? Many are free, like all free deposit.

Can I bank online only? Yes. App handles all: transfers, pays, checks.

What’s the best card for travel? ttb so fast or so smart. Free travel insurance.

How long for loan approval? Often same day if docs are ready.

Does TTB have branches? Yes, all over Thailand. Plus ATMs.

Can foreigners use TTB? Yes, with right ID.